- Purchase book entries: your purchases from suppliers.

- You can also record debit notes to suppliers.

1: What type of transactions should be entered to the purchases book?

2: How do I add a transaction?

- Click into the relevant book.

- Click onto the correct tabbed month along the top of the screen.

- Click ‘Add’ (or ‘Receipts’ if you wish to add a receipt, or ‘Payments’ if you wish to add a payment in the Cash Book). NB if you are in the sales book, select ‘Sales Book Entry’ or ‘Sales Invoice’ and click ‘OK’.

- Fill in/select the relevant information.

- Click ‘Save’ (Note, there is a ‘Sales/Lodge’ button also in the cash book which you can use if relevant).

- Follow any additional onscreen prompts.

- You can add another transaction straight away when the fields show blank after saving, or click ‘Cancel’ to close that dialog box.

3: How do I change a transaction?

- Highlight the relevant transaction.

- Enter the default password of ZZZ

- Click ‘Change’.

- Make the relevant changes.

- Click ‘Save’.

4: How do I delete a transaction?

- Highlight the relevant transaction.

- Enter the default password of ZZZ

- Click ‘Delete’.

- Click ‘Yes’.

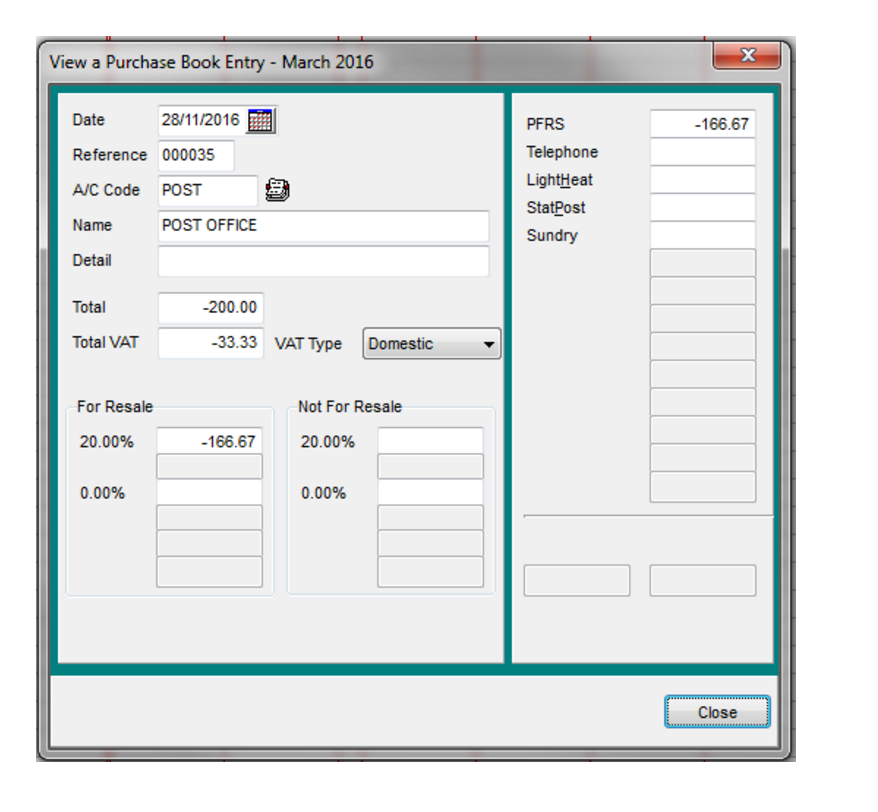

5: How do I add a debit note (supplier/purchases side)?

- Open the purchases book.

- Choose the correct tabbed month along the top.

- Click ‘Add’.

- Continue adding it as a purchase book entry but enter the minus symbol in front of all the figures.

- Click ‘Save’.

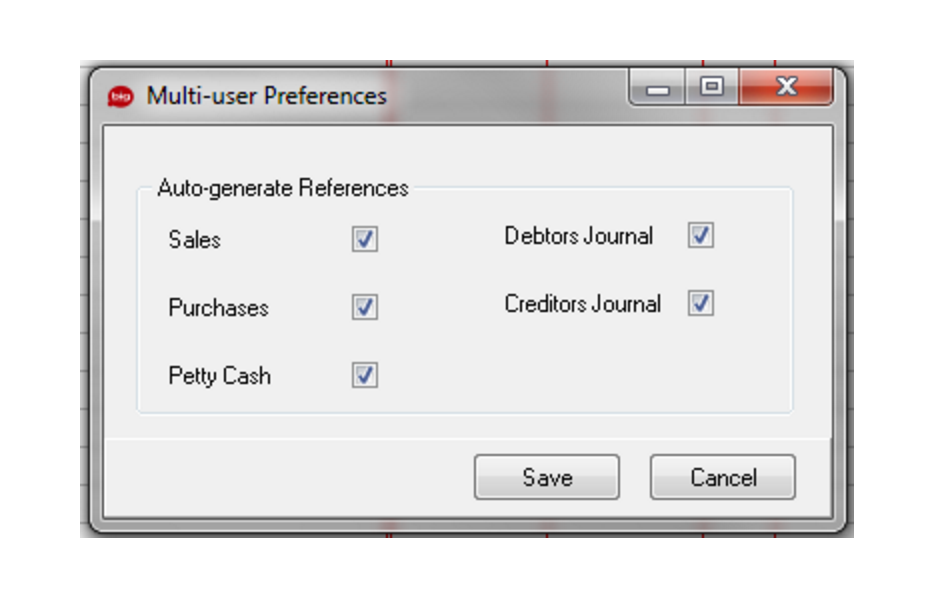

6: How do I change the reference from ‘Auto’ for purchases and/or sales?

- Click ‘Setup’.

- Click ‘Multi-user Preferences.

- Un-tick any of the books that you wish to be able to enter a reference.

- Click ‘Save’.

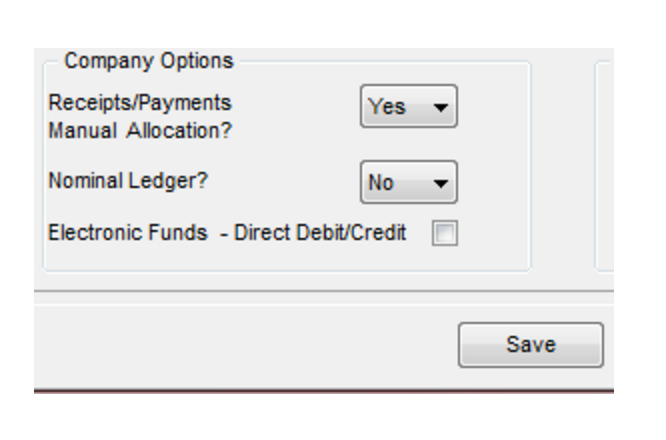

7: How do I start using receipts payments manual allocation?

- Note: If you start using receipts payments manual allocations, you will need to manually allocate customer/supplier transactions (when they are paid/allocated), or they will be seen as unpaid/unallocated within Big Red Book. This includes transactions already added in the current year in Big Red Book, transactions from previous years if you had previous years in Big Red Book, and transactions that you add going forward.

- To start using this, go to ‘Setup’ – ‘Options’ and switch ‘Receipts/Payments Manual Allocations’ to ‘Yes’.

- You will now get the option to allocate customer/supplier receipts/payments when you are adding them. You will also be able to allocate them from within the cash book/payments book and within the customer/supplier ledger.

- Note: If you are using receipts payments manual allocations and Vat on cash receipts, where the vat is based on the allocation of the receipt, you will need to ‘Submit’ the vat return within Big Red Book. This is not the actual VAT Submission, but it marks the allocated transactions in the period selected (and previous period’s transactions not ‘submitted’) to that period for the Vat on Cash Receipts return in Big Red Book, that way those transactions aren’t ‘submitted’ again in a later Big Red Book Vat on Cash Receipts report.

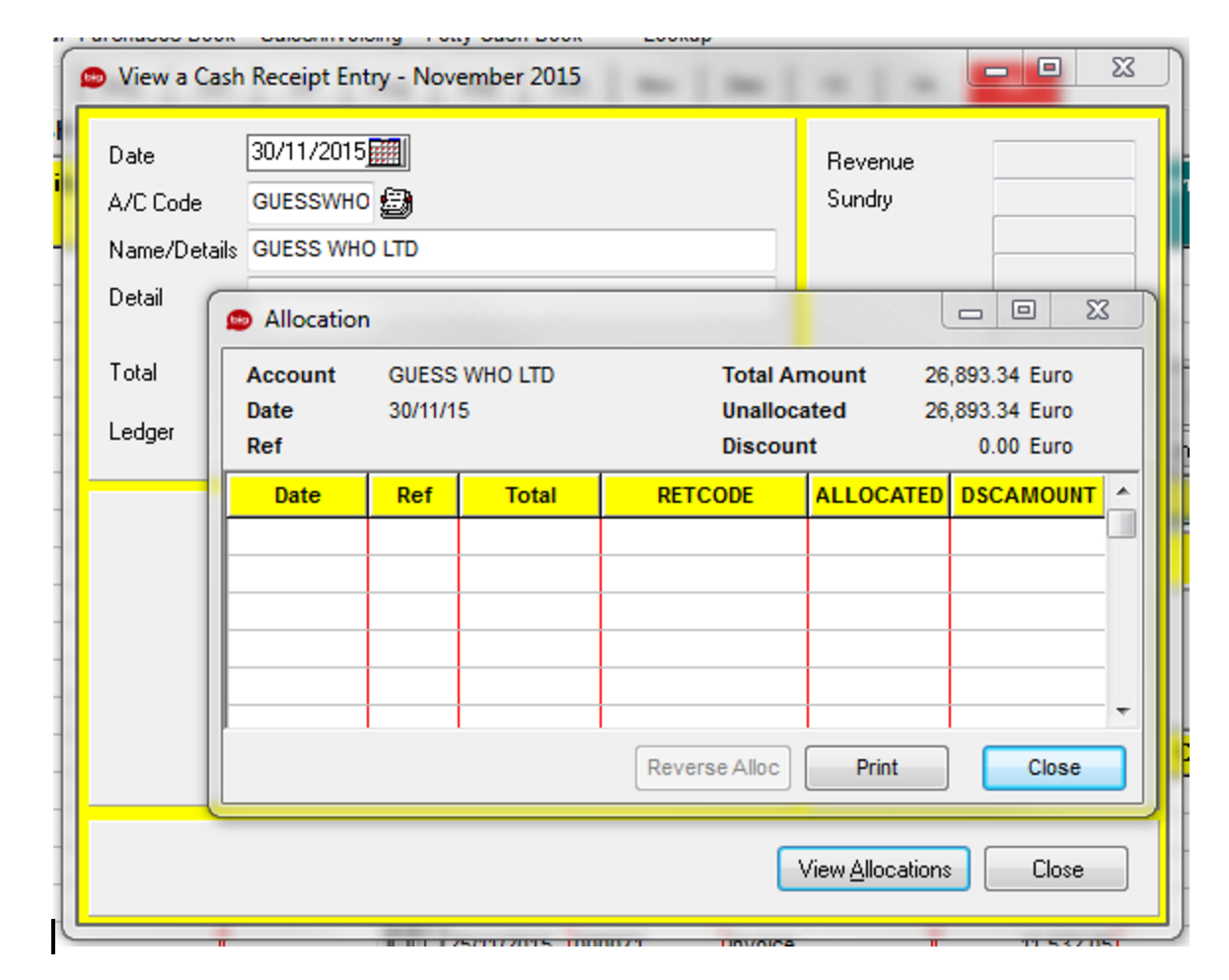

8: How do I un-allocate/reverse an allocation of a receipt/payment?

- Click ‘Lookup’/’Setup’.

- Click ‘Customers’/’Suppliers’.

- Highlight the customer or supplier.

- Click ‘Ledger’.

- Highlight the relevant receipt/payment.

- Click ‘View’.

- Click ‘View Allocations’.

- Highlight the allocation that you want to reverse.

- Click ‘Reverse Allocation’.

- Click ‘Close’.

- Note: You can also do this from the book that the transactions are entered (cash book or payments book) by highlighting the transaction, clicking ‘View’ and following steps as above (from ‘View’ downward).

9: How do I enter opening balances for customers and suppliers when receipts payments manual allocations is not being used?

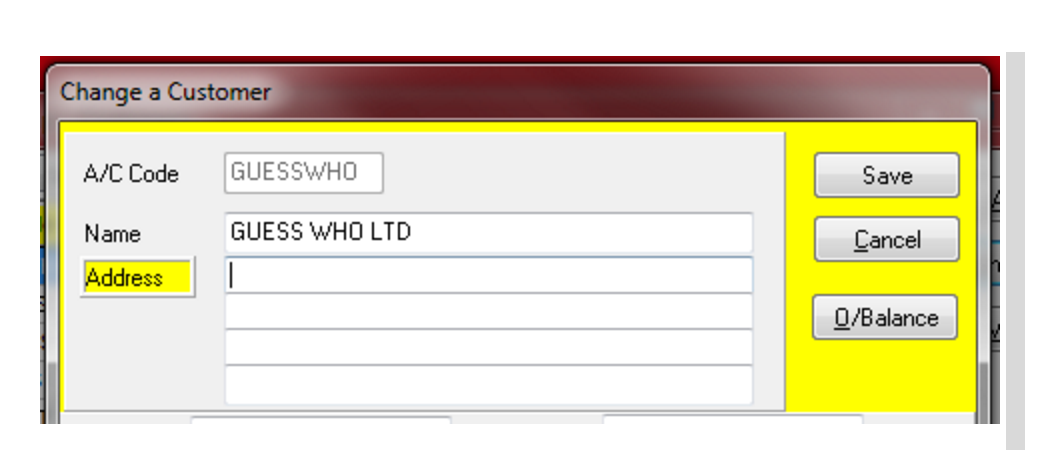

- Click ‘Setup’/’Lookup’ – ‘Customers’/’Suppliers’.

- Highlight the relevant customer/supplier.

- Click ‘Change’.

- Click ‘O/Balance’.

- Click into the ‘Current’, ‘1 Month’, ‘2 Months’ and ‘3 Months Plus’ fields and enter the portion of the opening balance which is relevant to each/any of these fields. On entering the value(s) the ‘Balance starting from’ field is automatically updated.

- Click ‘OK’.

- Click ‘Save’ on the ‘Customer/Supplier’ screen – this is the point at which the opening balance is actually saved.

- Note: While it is recommended that you should enter the ageing of the opening balance, if you do not know the ageing, Big Red Book will still allow you can enter the full balance in the any of the ageing fields.

10: Can I move a purchase book transaction to a different tabbed month?

No, but you can delete it from the wrong tabbed month and then added to the correct tabbed month.

11: How do I deal with a cancelled cheque to a supplier in Big Red Book?

- First consider what accounts (supplier, nominal, bank etc.) were affected by the initial transaction(s) (if initial transactions were added) and consider how you now want to affect those accounts.

- If the initial transactions were a purchase book entry and a payments book entry, then if you wish to now show your bank account increasing by the amount (as it never left your bank account, but had been shown as leaving your bank account) and the supplier’s ledger being adjusted by the amount, you can record a non-ledger (non-customer) cash receipt and save and lodge this (to correct your bank account). Then record a creditors journal adjustment, on the credit side (to correct the supplier’s ledger). Next, view the ledgers of the accounts affected to ensure that all is showing as it should be. After this it will show that the invoice is still owing. If you no longer wish to show the invoice as owing, you can record a debit note in the purchases book.

- Note: regarding the non-ledger cash receipt, you could set up an analysis category (‘Setup’ – ‘Analysis Categories’) for this e.g. calling it ‘Cancelled’ or something similar, so that you know what it refers to. If you are using the nominal ledger you can select/add a nominal account for this, beside that category (‘Setup’ – ‘Analysis Categories’) and then when doing the journal adjustment, you could select the same nominal to offset the journal adjustment against.

- You should check the ledgers of all affected accounts after to ensure all is showing as it should be.

12: Contra Entry

What to do when you have the same customer and supplier

Contra entries i.e. you buy €1,000 of goods from him and sell him €900 worth of goods.

- Make a purchase book entry of €1,000 in the purchases book.

- Make an entry in the sales book for €900.

- Enter a cheques journal entry for €100. (Note: if the sale is higher than the purchase than for step 3 you do cash receipt (not cheques journal entry). All other steps are the same.

- Do a creditors journal entry for €900 on the debit side.

- Do a debtors’ journal entry for €900 on the credit side.

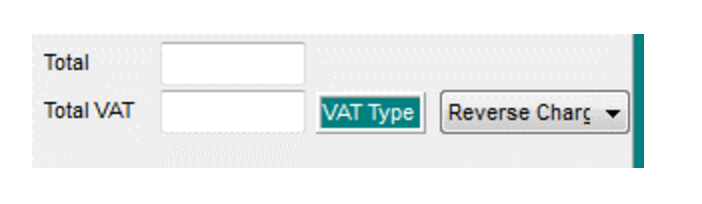

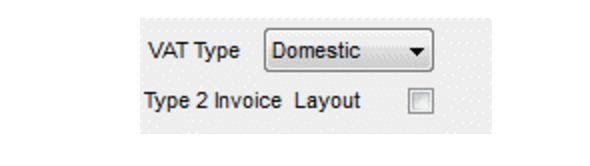

13: How can I account for VAT on reverse charge basis in Big Red Book?

For purchases: when adding the purchase book entry in the ‘VAT Type’ field choose ‘Reverse Charge’ and then enter the transaction. Note: the ‘Total’ figure is the net figure in this case, rather than the gross figure.

For sales: when adding the sales invoice, tick the ‘Type 2 Invoice Layout’ button. This will show this invoice when previewing/printing with the line ‘VAT on this supply to be accounted for by the principal contactor’ and it will not display a VAT breakdown.

14: How can I enter a Vat only purchase entry?

- The best approach to entering Vat only invoices is to think of them in conjunction with the original invoice from the foreign supplier. Example: Original invoice: Total = 20,000. 0.00% = 20,000. Vat type: Foreign Non EU. Beside the Analysis Category(s) = 20,000. VAT Only Invoice: Total = 4,000. Total Vat = 4,000. Vat Type: Foreign Non EU. 20% = 20,000. 0% = -20.

15: What is the book enquiry?

- It allows you to filter transactions within books and export/print it. For example: You could run a book enquiry on the cash book, to show all transactions for a particular customer between a number of months’ range, and to only show transactions over €100 for them.

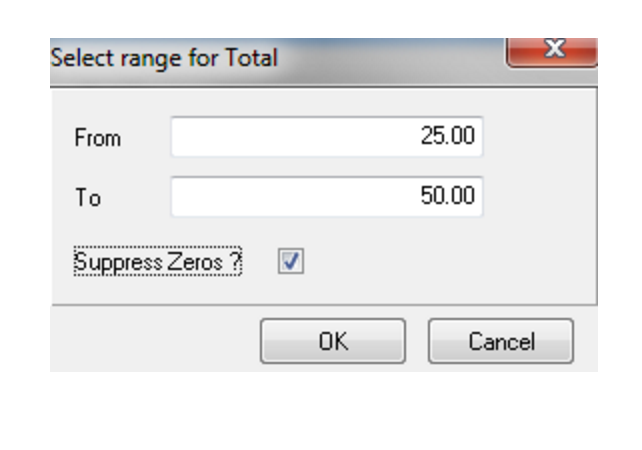

16: How do I use the book enquiry?

- Click ‘Reports’.

- Click ‘Book Enquiry’.

- Select the relevant option/book.

- Highlight a cell in a relevant column. Example highlight cell in the total column.

- Click “Set Range” at the bottom of screen.

- New window opens “Select range for total”

- If you are looking for a value between 25 and 50 in the From type 25 and in the To type 50. Click ok.

- It will now show all transactions with a total between 25 and 50.

17: How do I see a summary of the figures for my analysis categories?

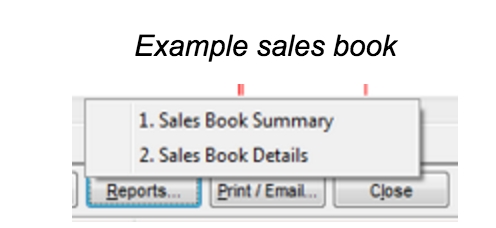

- Within the book that you want to see this for, click ‘Reports’.

- Choose the ‘Summary’ or ‘Details’ Report.

- With sales book and purchases book ensure ‘Analysis’ is select before you display it.

- With the payments book ensure that the relevant bank is selected at the bottom of the screen.

- With the cash book, you can run the ‘Listing’ reports for receipts and payments.

18: Can I change a customer account code/ supplier account code/ bank account code?

- You cannot change a supplier, customer or bank account code once it has been setup.

- If it is something that you must change, then you can delete the customer / supplier / bank account and then add them again with the correct account code.

- Note: You will not be able to delete a customer / supplier or bank account if there are transactions against their ledger.