1. Background

Please refer to the following links for further information:

http://www.revenue.ie/err

https://www.revenue.ie/en/employing-people/documents/enhanced-reporting-requirements-faqs.pdf

From January 1st, 2024, employers must report details of certain expenses and benefits made to employees and directors. These details must be reported/submitted on or before the date that the expense or benefit is made available or paid to the employee.

This is an expansion of legislation that is already in place. Employers are already required to maintain records for payments made under Travel & Subsistence, Remote Working Daily Allowance and Small Benefits Exemption. The new requirement is that this information must now be reported to Revenue before the reportable benefit is made available to the employee/director. Some employers will previously have paid these expenses and benefits through payroll. Some will have used expense management software. Some may have used both Payroll and expense management software. Others may have just paid out via cash or issued gifts such as gift cards and hampers. Many will not have made any such payments at all.

Payroll 2024 will allow employers to assign an expense or benefit type to a rate of pay and these will then be used report these expense and benefits to Revenue as required. This will allow employers paying these expenses and benefits through Payroll 2023 to continue using the same system with minimal change needed while also allowing employers using Payroll for expenses and benefits for the first time to get up and running without a large effort.

It is also vital to recognise that there will be employers who will not be paying any of these expenses and benefits, and at the same time most who will be paying expenses and benefits will not be paying all of them. Finally, employers will also need to recognise that the date to be reported is the payment date and not the date to which the payment relates.

2. ERR Permissions for ROS Certs

Revenue will be in contact with Employers and Agents directly to inform them of these requirements.

3. Employer ROS Permissions

Employers who are using their main Admin cert in Payroll will not need to do anything, ERR permissions will automatically be added to their cert.

Users whose employer had issued them a ‘Payroll Only’ sub-cert will require the employer to assign a new ‘Payroll & ERR’ sub-cert to them, assuming they wish make ERR Submissions also. This new cert will then need to be linked to Payroll.

4. Agent ROS Permissions

Agents registered as a Financial Agent will not need to do anything, ERR permissions will automatically be added to their cert.

Agents registered as a Payroll Agent will need to apply to Revenue to become and Payroll & ERR Agent, assuming they require the ability to make ERR submissions also.

5. Setting Up Enhanced Reporting Rates of Pay

All changes to rates of pay should be done before beginning to make reportable expense and benefit payments.

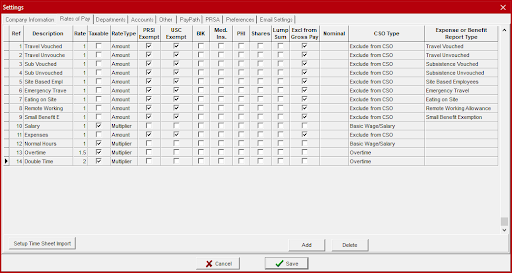

Users will be required to either edit existing or add new Rates of Pay to include a category for the ‘Expense or Benefit Report Type’ to link to the Rate of Pay. These can be selected via a dropdown in the Settings > Rates of Pay grid.

It is possible to have multiple Rates of Pay with the same ‘Expense or Benefit Report Type’ selected. As a rate of pay may only be used once in an employee’s timesheet, multiple rates of pay will need to be setup in order to include the same Expense and Benefit Type in the same payment record more than once, should it be required.

6. Editing Existing Rates of Pay to use for Enhanced Reporting

Should an employer already record Travel & Subsistence, Remote Working Daily Allowance or Small Benefits Exemption in Payroll using separate rates of pay, then these existing ‘Excl from Gross Pay’ rates of pay simply need to be assigned a category in the ‘Expense or Benefit Report Type’ column to match the category to which they refer.

It should be noted that before now employers may have bundled some or all of their Expense and Benefits together under one rate of pay. They will now need at least one rate of pay for each category that they wish to report and that not all expenses are becoming reportable either.

7. Adding New Rates of Pay for Enhanced Reporting

All ERR Rates of Pay should be set up as

- Description: Can be a maximum of 15 Characters

- Rate = 1

- Taxable = unticked

- Rate Type = Amount

- PRSI Exempt = ticked

- USC Exempt = ticked

- BIK = unticked

- Med. Ins. = unticked

- PHI = unticked

- Shares = unticked

- Lump Sum = unticked

- Excl from Gross Pay = ticked

- Nominal: Set if required

- CSO Type = Exclude from CSO

- Expense or Benefit Report Type: Set as required from the options as listed below.

- Note: the dropdown for the Expense or Benefit Report Type column will not be active until all other options have been correctly setup.

8. Enhanced Reporting Categories

Travel & Subsistence

There are 7 sub-categories of Travel & Subsistence that must be reported.

- Travel Vouched

- Travel Unvouched

- Subsistence Vouched

- Subsistence Unvouched

- Site-based Employees (including what’s known as ‘Country Money’)

- Emergency Travel

- Eating on site

- An Employer must report the total amount to be paid for each sub-category for the payment date.

- It is allowable to make more than one payment for the same Expense and Benefit type in the same payment record.

- However, a rate of pay may only be used once in an employee’s timesheet so multiple rates of pay will need to be setup in order to include the same expense and benefit type in the same payment record more than once.

- It is allowable to make more than one payment for the same Expense and Benefit type in the same payment record.

- Revenue Information can be found here.

Remote Working Daily Allowance

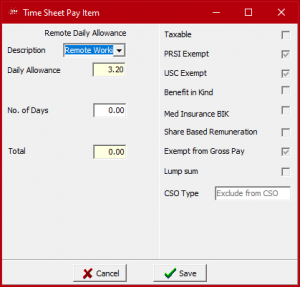

When paying a Remote Working Daily Allowance, employers must report the total amount to be reported as paid to an employee as well as the number of days that the payment covers.

- An employer may pay an employee €3.20 per day without deducting Income Tax, USC or PRSI.

- This is to cover the additional costs of working from home, such as electricity, heat, and broadband.

- Additional costs might be higher than €3.20, and an employer may pay these higher costs. However, any amount more than €3.20 per day paid should be taxed.

- Revenue Information can be found here.

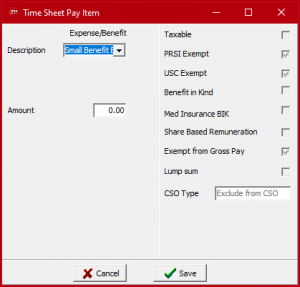

Small Benefits Exemption

An employer can pay a maximum of two benefits in a tax year, the cumulative value of which cannot exceed €1,000. It is only the first two qualifying benefits that are exempt.

- If a benefit exceeds a cumulative €1,000 in value, the full value of that benefit is subject to tax.

- If a single benefit is €1,100, then the full €1,100 is taxable.

- If a first benefit is €500 and a second benefit is €600, then the full €600 of the second benefit would be taxable.

- A third benefit in the same tax year would be fully taxable even if the €1,000 limit has not exceeded by the first two qualifying benefits.

- If a first benefit is €50, a second benefit is €100 and a third benefit is €200, then the full €200 of the third benefit would be taxable.

- Revenue Information can be found here.

9. Creating Expense and Benefit Payments via Timesheets Screen

Entering these will be familiar to current users of Big Red Book Payroll.

Click on the Timesheets Icon and select the payroll date. The payroll date should be the date that the employee will be paid. If required, the wage interval can also be selected here.

Import Time Sheets

Importing Timesheets can be used, however if any rates of pay have been added or had their description changed, then a new import timesheet must be created and mapped to be used:

Auto Add Timesheets

As the nature of most of the Expenses and Benefits payments is that they will be irregular amounts and/or occurrences Auto Add Timesheets may not be suitable for these payments aside from Remote Working Allowance but can be used if required.

Manually Adding Timesheets

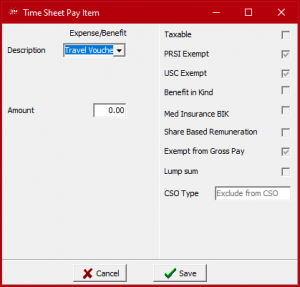

To manually enter data for individual employees, select the employee required on the list, click on the ‘Add Time Sheet’ button. The Time Sheet Pay Item screen will be displayed. Select a Pay Rate from the description dropdown. Fill in the details as required. Then click the ‘Save’ button. There will then be the option to add a further Pay Item.

Adding Expense/Benefit Rates of Pay 1: Travel & Subsistence

Adding Expense/Benefit Rates of Pay 2: Remote Working

Adding Expense/Benefit Rates of Pay 3: Small Benefit Exemption

10. Adding Standalone Expense and Benefit Payments

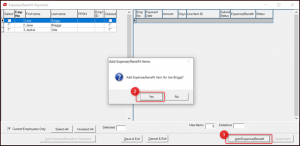

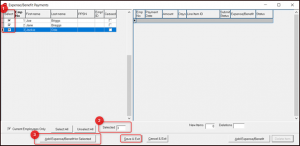

The user clicks on Payroll Menu, then Expenses & Benefits, this will open an Expense/Benefit payments window.

If a user wants to add an Expense or Benefit for just one employee, highlight that employee

- Click Add expense/benefit button

- A confirmation screen will show, confirm it is for the correct employee and tick yes.

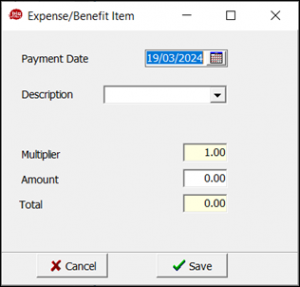

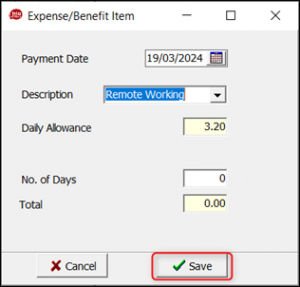

An Expense and Benefit item window will pop up for the user, they need to add the date the payment applies to and choose a description of the payment, the user will notice that the layout for most of the payments are the same, except for WFH Allowance.

When choosing WFH Allowance the layout changes to show a daily allowance rate of 3.20, the user can then add the number of days that this allowance applies to and the system will automatically calculate the amount in the box, click save when done.

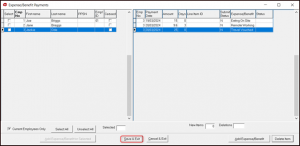

When the user has finished adding payment items for all employees, click Save & Exit, items will not save otherwise.

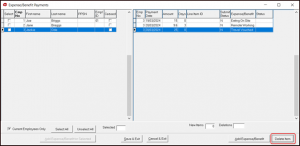

Adding a Batch entry

To do a batch entry, the user will need to select more than one employee,

- Tick the box on the left of the employee’s name,

- The selected box at the bottom will show the number of employees in that batch entry

- User then ticks Add Expense/Benefit for Selected.

A batch entry can be done once the payment type and amount are the same for the selected employees.

When user has finished adding payment items for all employees, click Save & Exit.

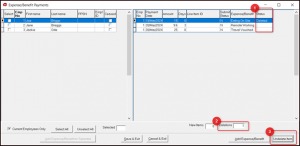

Deleting an Item

If a user needs to delete an item, they can highlight the employee and highlight the item, click delete item.

Once an item has been deleted

- the status of the item will change to show “Deleted.”

- The deletions box will show the number of deletions in total

- The delete item button will change to Undelete item.

When user has finished deleting payment items for all employees, click Save & Exit, the changes will not take place otherwise.

The deleted item will show on the list, only when the window has closed and reopened, will the item no longer show for the employee.

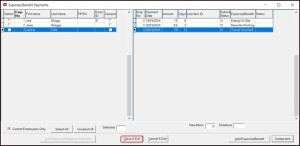

11. Submitting Expenses and Benefits Payments

Should a user wish to submit Expense and Benefit payments without creating a timesheet, payslip or having to send a Payroll Submission, they can choose to use the option from the menu,

Payroll > Expenses & Benefits.

This will open a screen which shows employees listed on the lefthand side, the screen also shows the relevant details for Enhanced Reporting Requirements.

12. Reports

Users will be able to run a Pay Type Analysis report to review Expenses and Benefits Rates of Pay, the Gross to Net Report will show all non-gross pay which will include Enhanced Reporting Expenses and Benefits. All Enhanced Reporting Expenses and Benefits payments except for Small Benefits Exemptions will be included in Actual Pay in reports. The Expense/Benefit Submission Enquiry has been added which will show the details of all Expenses and Benefits that have been submitted.

Q&A

Does this include mileage - ( kms x civil service mileage rate) for travel to events - usually this is paid month in arrears of travel taken.

If you’re paying under travel & subsistence rules it will be reportable. you can still pay in arrears as long as the pay date is submitted to ROS on or before the payment is made

For SB Voucher should BIK not also be ticked in pay rates?

Small benefit is not a BIK

Will all or any of this information be shown on the payslip?

These are entered as rates of pay so will show on payslip in the same manner as any rate of pay

Is the software going to always default the message ``Add another pay item`` every time wages are being processed?

Yes, this is how it is currently

Are the standard expenses going to be setup already in BRB 2024 ? (e.g. civil services rates, remote working etc.)

No, not all users will use these the same way, also not all employers will use them at all.

So there's two submissions to be done every time ERR comes into play

Yes, Revenue have created a separate submission process for ERR

So each time you have addition like this you need to do a separate submission after the payroll submission

Yes, the way revenue have designed this will mean you need to do 2 submissions, 1 for payroll items and 1 for ERR items

For a monthly payroll - can the expenses submission to ROS be submitted at any stage during the month, and on a number of different dates?

Once the ERR is submitted on the day or before he Employee receives it.

Can you do the ERR submission separately to payroll or does it have to be filled in / completed at the same time

It can been done alongside the normal Payrun or Submitted separately

How do you know what certificate you have? If it is payroll only?

You will need to contact ROS as there is no way of knowing a CERT has pacific permissions in the Payroll Software.

Hi, If we currently keep payroll and expenses separate can we only use the BRB system if we combine the process? Thanks

You’ll need to add timesheets with your expenses & benefits in Payroll if you wish to report to ROS via Payroll

What about small benefit exemption, it will show in deduction section? or it will form part of net pay ?

Non gross pay generally is part of actual pay, but as small benefit is a non cash payment we will not add this payment to actual pay

Can a separate run be done for expense submission on a separate day to payroll processing?

Yes, it will need to be done as a supplementary. But not in advance of a normal payrun period.

Just to confirm - we do not have to report for Dec 2023

Anything reported/paid in 2024 will need to be reported.

We use one4All vouchers for Christmas, we may give different values amounting to about €800 just at Christmas, is that allowed considering we can only give 2 payments during the year

A maximum of two gift payments are allowed up to €1000. Any additional gift payments even if it does not exceed the yearly €1000 will be fully taxable.

If December M&T isn't paid until January does it have to be reported?

Yes anything reported/paid in 2024 will need to be reported.

What is the time limit between reporting expenses to ROS and paying the expense

Anything being paid needs to be notified to ROS on the day or before it is submitted to ROS

Do you only submit this new benefit submission report when you make a benefit or do you have to submit it every payroll ? Even if you don’t pay any employee benefits that payroll

ERR only needs to be reported to ROS when it is required. It would not be recommended to submit zero values as expenses.

We have one employee based outside of the country and paid via a payroll company in that country. How do we report any expenses paid to them

This is something to discuss with Revenue/Accountant/Tax Advisor

What date do you recommend to put in on the run date?

The run date should the date the employee is going to be paid. This should be submitted to ROS on the Day or before employee.

If an employee buys a part, and it gets paid afterwards, does this need to be notified

This is something to discuss with Revenue/Accountant/Tax Advisor

Our company uses leap card and lynks tax for EE. leap card auto top up. do we have to report this to revenue?

This is something to discuss with Revenue/Accountant/Tax Advisor

Travel exp paid by business credit card-not reportable right?

This is something to discuss with Revenue/Accountant/Tax Advisor

My company automatically pay for hotel and food for engineers who have to stay overnight, how does this need to be reported?

This is something to discuss with Revenue/Accountant/Tax Advisor

But in general if company pay hotel directly then no

If an employee is fully remote, do they get the allowance for a week when they are on holiday?

This is something to discuss with Revenue/Accountant/Tax Advisor

But in general it is only for days worked at home